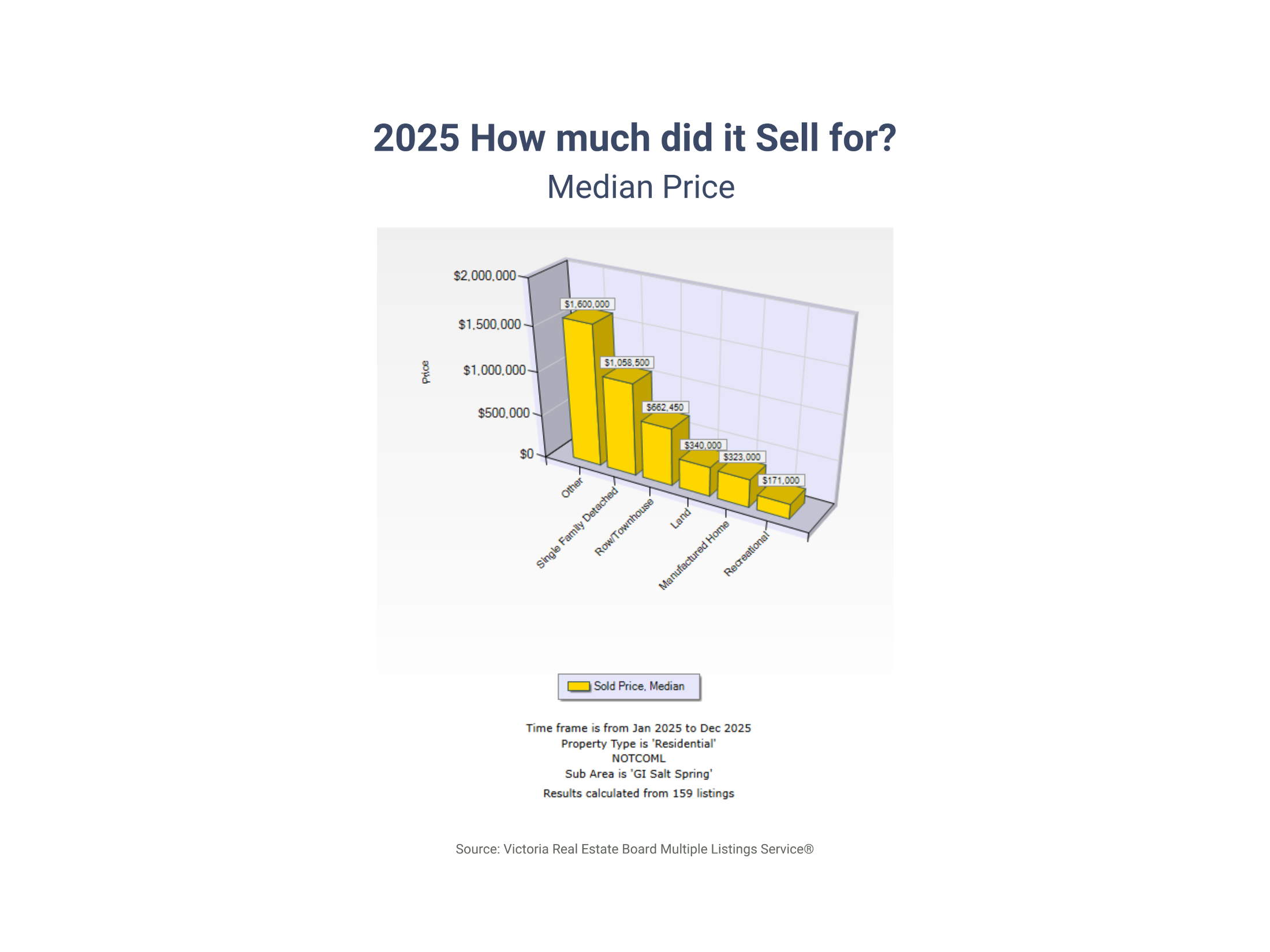

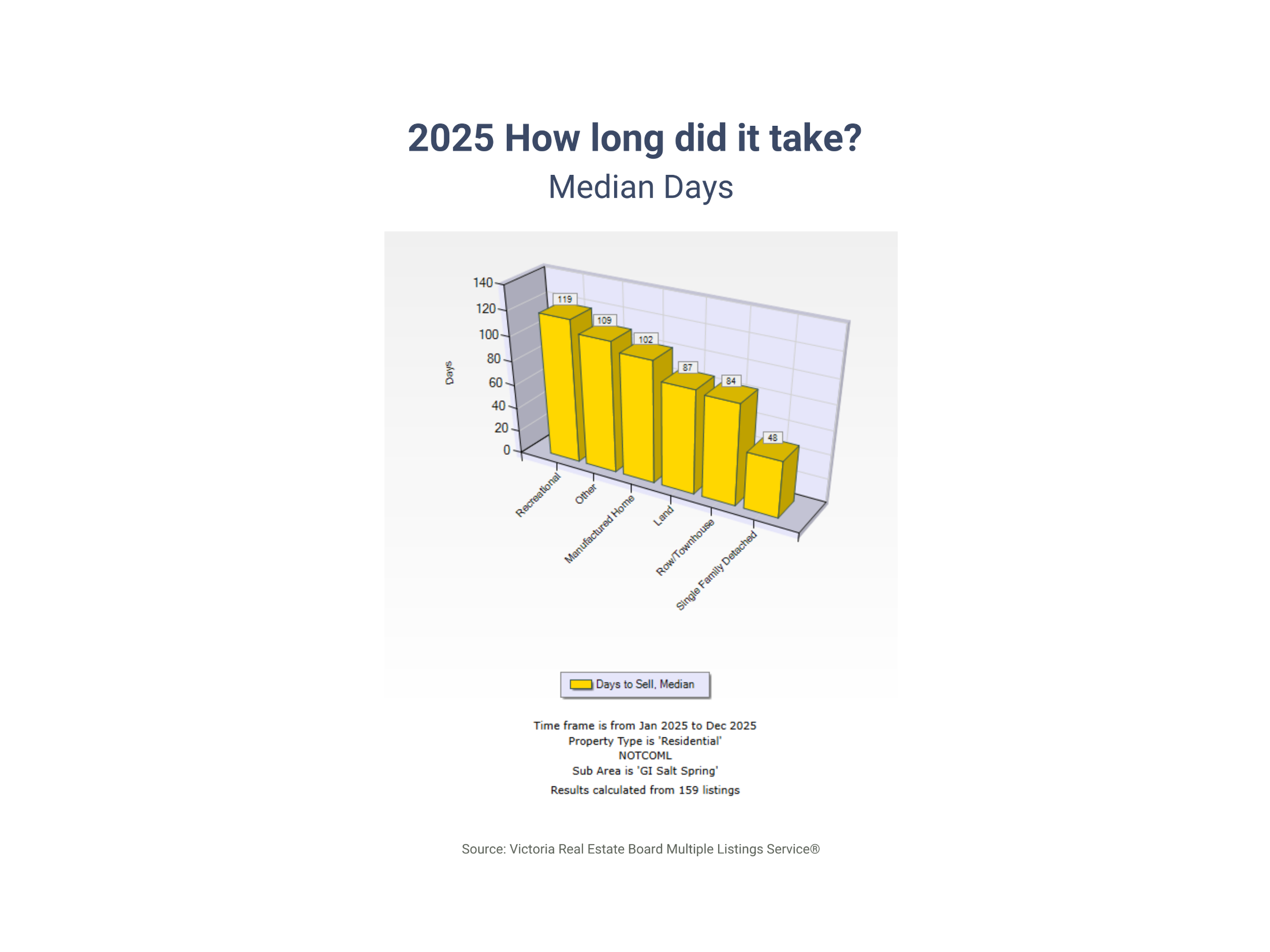

2025 was a year of stabilization and selective growth in Salt Spring Island’s real estate market. Given the Island’s small and highly individualized market, median prices provide the most reliable insight, as a few high- or low-value sales can skew averages. This report combines median pricing, sales volume, days on market, and 10-year trends with property-type and oceanfront data to give a comprehensive market overview.

The data is derived from the Victoria Real Estate Board MLS data and might not include a few sales completed privately or on other boards.

Overall Market Performance

The Island saw modest median price growth and faster sales, particularly for well-priced residential properties. However, small sample sizes mean trends should be interpreted cautiously.

Median Sale Price (All Properties): $861,250 (2024) → $900,000 (2025)

Median Days on Market: 69 (2024) → 59 (2025)

Inventory Context: 2025 active listings show modest fluctuations throughout the year; absorption rates indicate a balanced market overall.

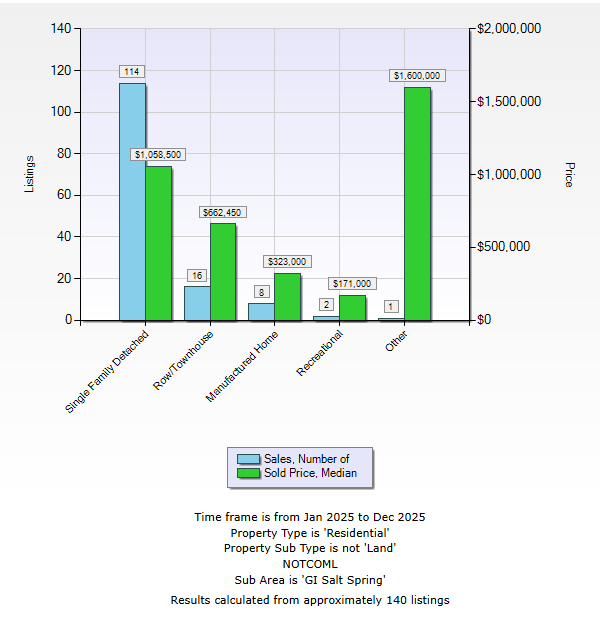

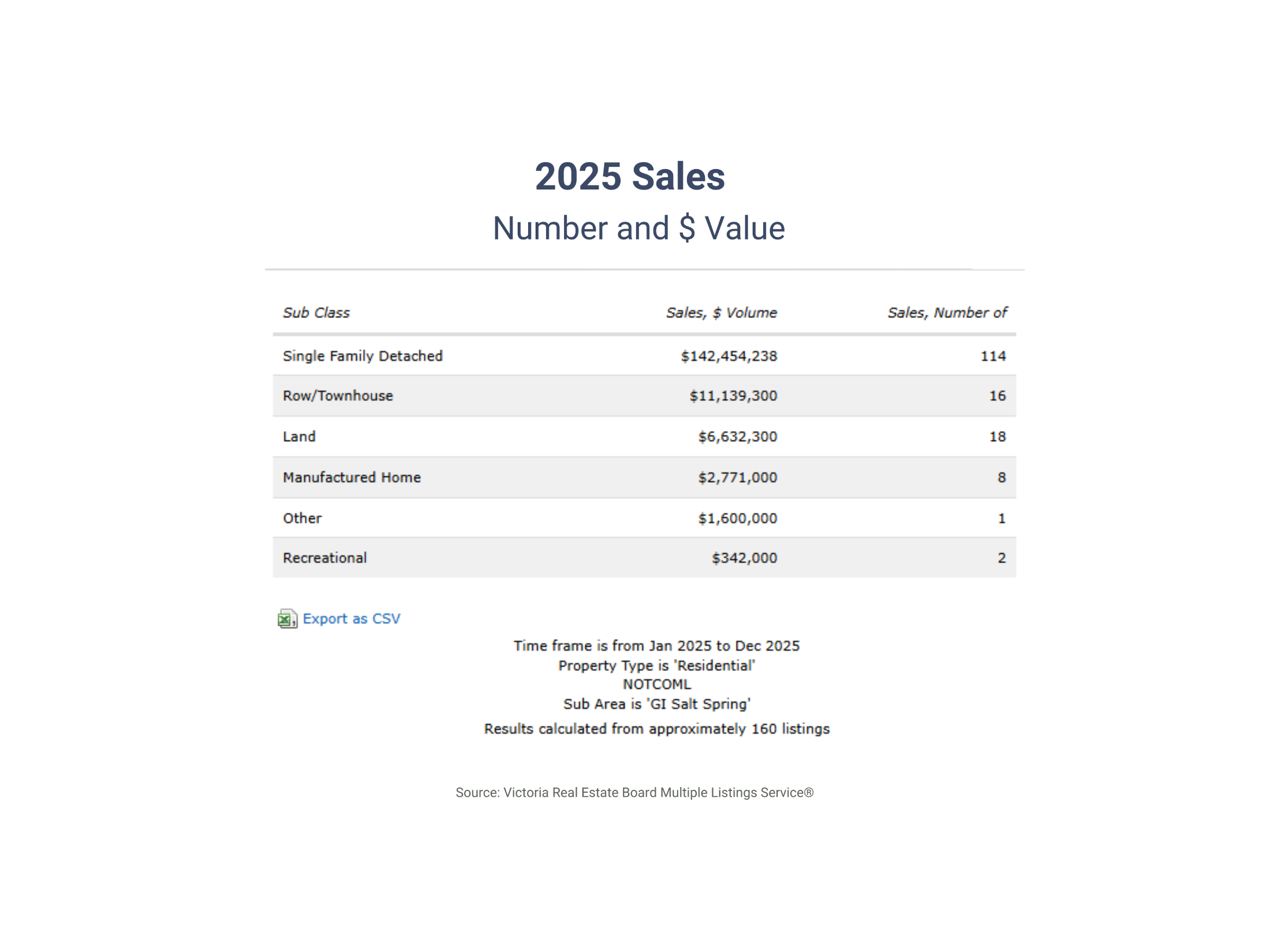

Single-Family Homes

Single family homes remain the market backbone and continue to dominate market activity. Oceanfront homes accounted for a significant portion of high-end sales. We also saw the return of some modest homes which were more accessible to entry-level buyers. This segment highlights the diversity of Salt Spring Island’s residential market.

Median Sale Price: $1,032,500 (2024) → $1,058,500 (2025)

Units sold 114

High-Value Activity:

9 homes $2M–$3M

3 homes $3M+

Oceanfront SFDs: 16 homes

Notable Extremes:

Least expensive: $440,000 — 2-bed cabin on 0.6 acre

Most expensive: $4,300,000 — nearly 5 acres with views, main house, cottage, studio/workshop but not waterfront

Condos & Townhomes

The median price decline reflects the mix of properties sold rather than broad market weakness. One oceanfront townhome closed in 2025. Well-priced condos and townhomes sold efficiently, while higher-priced units were less common.

Median Sale Price: $700,000 (2024) → $662,450 (2025)

Units Sold: 16

Oceanfront Condo/Townhome Sales: 1

Manufactured Homes & Other Properties

Manufactured Homes Sold: 8

Recreational/Other Sold: 3

Land Market

The decrease in median land price reflects which parcels sold in 2025—more modest or lower-priced lots were active, while larger or prime parcels were less frequently sold. Serviced and well-located lots remained desirable.

Median Price: $449,500 (2024) → $340,000 (2025)

Units Sold: 18

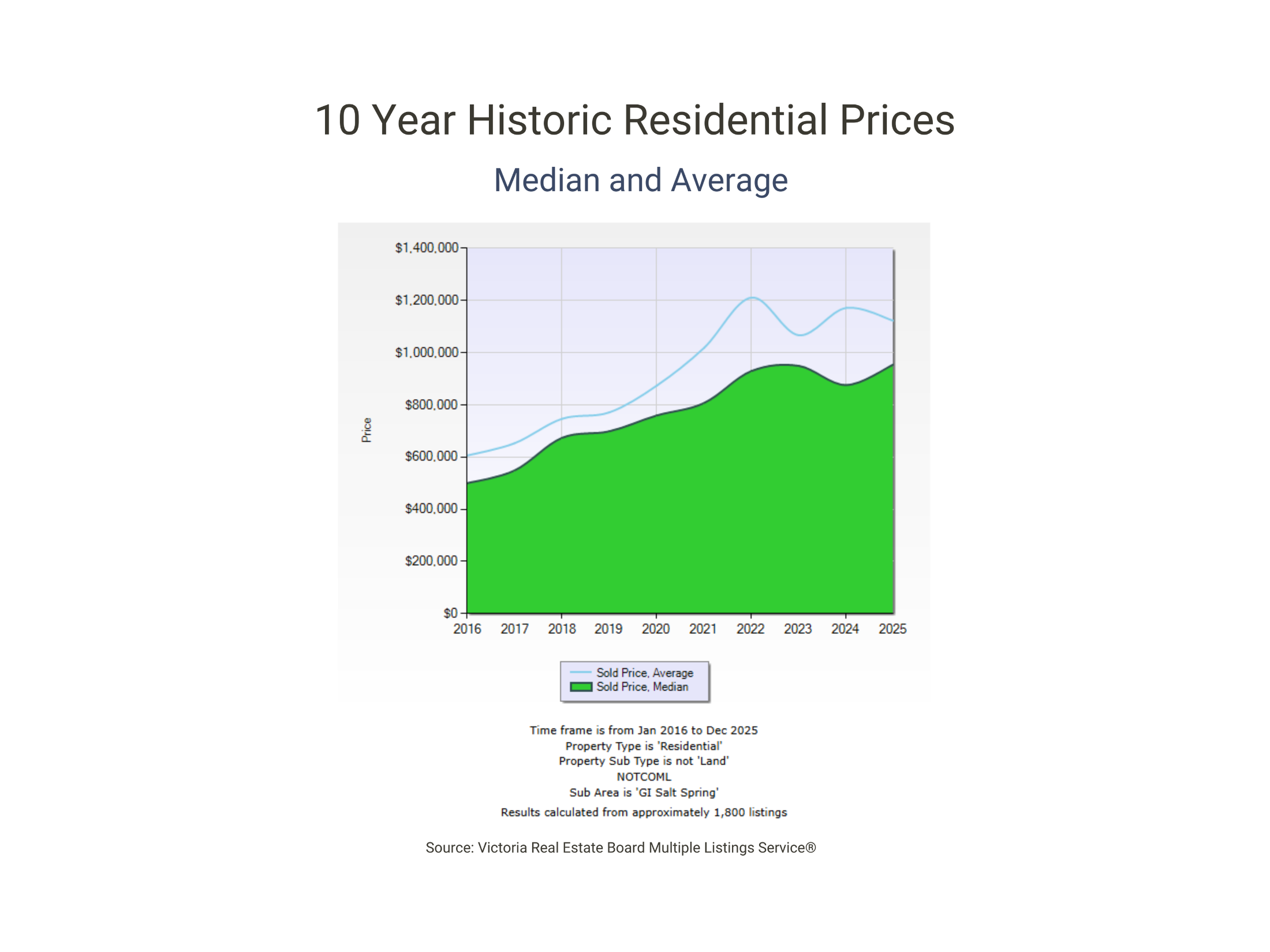

Market Trends & Historical Context

Salt Spring Island is a collection of micro-markets. Historical trends show long-term price growth but highlight the variability of smaller segments. Inventory levels, seasonal trends, and buyer interest in oceanfront or premium properties continue to influence sales.

10-Year Residential Sales

Median prices have generally risen over the decade; averages highlight influence of high-end sales

10-Year Land Sales & Prices:

Land prices fluctuate more, influenced by parcel size, location, and market availability

10-Year Residential Sales & Active Listings

Provides perspective on long-term activity and supply trends

Key Takeaways for 2025

Median prices up modestly: $861,250 → $900,000; days on the market decreased 69 → 59 days

Single-family homes lead market activity; oceanfront and luxury properties remain key drivers

Seasonal trends are evident, but well-priced listings consistently sold quickly.

Condo and land median declines reflect the mix of properties sold, not broad market weakness

Small-market caution: Each property is unique; median trends provide guidance but are not definitive

Strategic pricing and awareness of micro-markets remain critical for successful sales